Retroactive pay (retro pay) is a payment made to an employee to make up the difference between what was paid and what should’ve been paid. It can occur when salary is increased in the middle of a pay cycle or a bonus that was earned in a prior pay period is paid.

Disclaimer: Fit Small Business does not provide legal or tax advice. Be sure to confirm your retro pay calculations with your payroll provider or tax consultant.

Retro Pay Calculator

If you’re doing payroll and need to calculate retro pay quickly, manually calculating it can be a hassle, especially for complex situations. To help, we’ve provided a simple retroactive pay calculator with a radio button option that lets you calculate retroactive pay amounts for hourly and salaried employees. Before using, keep in mind that the calculator isn’t able to calculate the effect of overtime in prior pay periods.

If you need an easy way to disburse retroactive pay to your employees, consider Gusto. You can run unlimited payrolls, including off-cycle ones, at no additional cost. You can also schedule compensation changes within the software to prevent retro pay calculations altogether, ensuring your employees are paid right the first time. Sign up for a 30-day free trial today.

Regular Pay vs Retro Pay vs Back Pay

It’s easy to confuse regular, retro, and back pay as they are all payments made to employees; however, different rules govern when and how you should pay each. Regular pay is the wage you pay your employees per pay period, typically based on an annual salary (salary/number of pay periods) or hourly rate (hours worked x pay rate). Retroactive pay is the difference between the regular pay you disbursed and the regular pay you should’ve disbursed.

Retroactive pay isn’t the same as back pay, although some people mistakenly use the terms interchangeably. To reiterate, retroactive pay is the difference between what was supposed to be paid and what was paid. Back pay is paying someone for time worked in the past that was never paid in the first place.

Back pay is typically court-ordered, subject to damages, which doubles the amount of back pay due, and less common. Similar to regular pay, it’s a simple calculation of the number of hours worked multiplied by the pay rate. Retro pay, however, is the number of hours worked multiplied by the difference between what was paid and what should’ve been paid.

How to Calculate Retro Pay

When calculating retroactive pay, you need to ask yourself a few questions first. For example, you need to know how long the employee was paid incorrectly, the pay rate they were paid for the timeframe in question, and the rate of pay they should’ve received for the work.

Other questions to ask yourself are:

- Is the employee hourly or salaried? (so that you know which pay rate to use)

- Is the employee exempt from overtime, or do overtime hours have to be considered?

- Does the retroactive pay affect only one pay period or more than one pay period?

- Was the retroactive pay caused by missed hours, which may affect overtime calculations and need to be paid at overtime rates, or only a discrepancy in the pay rate itself?

In most cases, even with the best payroll providers, retro pay has to be determined outside of the regular timekeeping system and manually input as miscellaneous income into the payroll system.

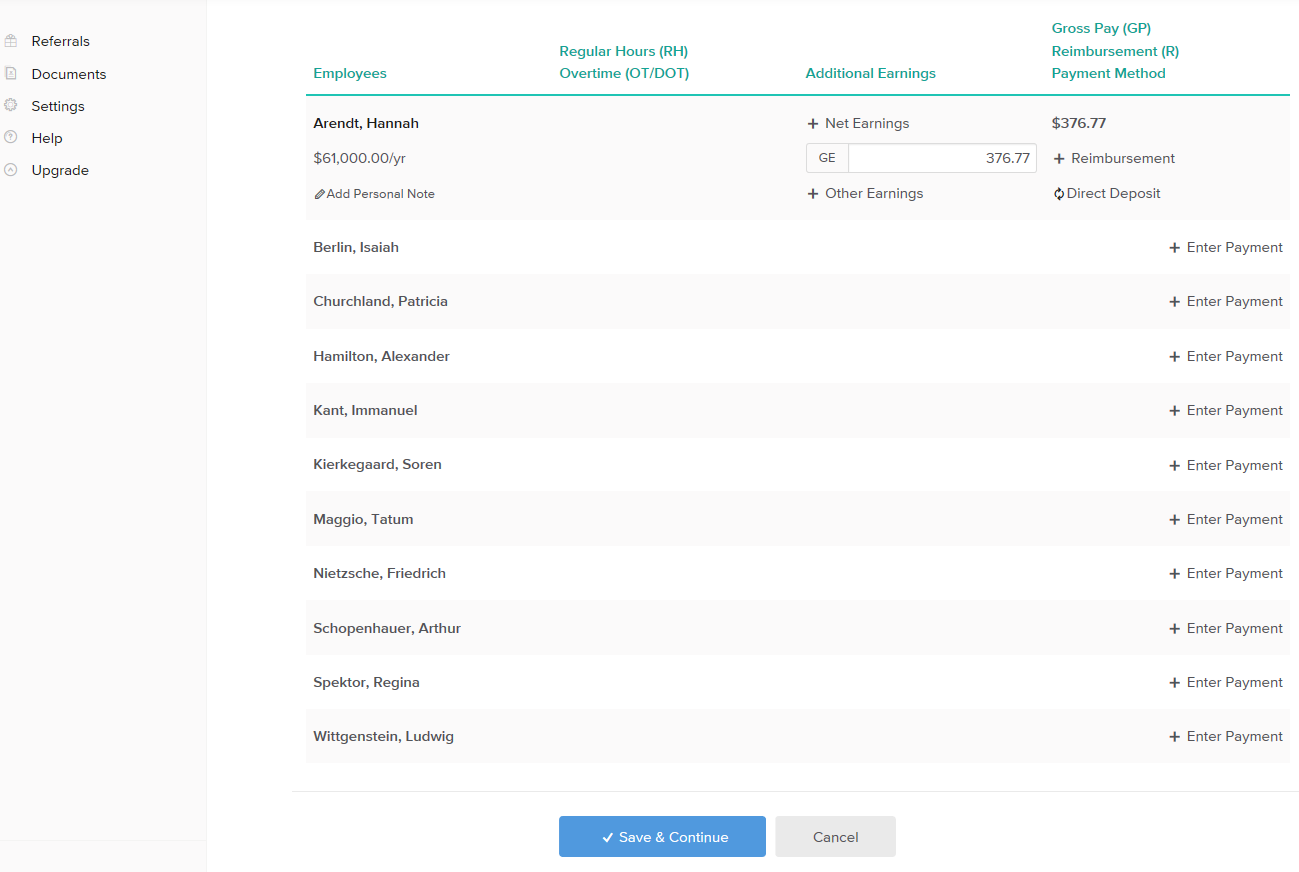

If using Gusto to make a retroactive payment due to a salary change in the middle of the pay period, you need to calculate the adjustment on your own and manually enter as an off-cycle payment.

Here are two simple ways to calculate retroactive pay.

Calculating Retro Pay for Hourly Employees

To determine retro pay for an hourly employee, you’ll need to know how many hours were paid at the wrong rate so you can determine the rate you need to pay to correct. You’ll multiply the differential rate by the hours paid incorrectly to calculate the gross retroactive pay amount. Taxes should be deducted from the gross amount to determine the net amount the employee should receive.

Example: 80 hours were paid to Sam last pay period using the wrong pay rate of $10 an hour. The correct pay rate should have been $12 an hour.

Here’s how to calculate the retroactive pay Sam is owed:

- Calculate the difference between pay rate paid and the pay rate that should’ve been paid:

$12 correct pay rate – $10 incorrect pay rate = $2 an hour difference

- Multiply hours paid incorrectly by the difference in pay rate calculated above.

$2 pay rate difference x 80 hours paid incorrectly = $160 owed in retro pay

$160 is the gross amount of retro pay Sam is owed

Calculating Retro Pay for Salaried Employees

Calculating retroactive pay for salaried staff is a little more difficult than calculating for hourly workers. You’ll need to know the difference between the annual salary the employee was paid and the salary that should have been paid. In addition, you should be able to verify the number of payroll days in the year.

Example: Sue’s annual salary was increased from $57,500 to $60,000 a year based on her performance review and should have taken effect at the beginning of the month. However, the month began a few days into the pay period, so her last paycheck was paid at the old rate of $57,500, when in fact 12 days in that pay period should have been paid at the new rate.

Here’s how to calculate the retro pay that Sue is owed:

- Calculate the difference between the annual salary rate at which the employee was paid versus what rate should’ve been paid.

$60,000 – $57,500 = $2,500 a year difference

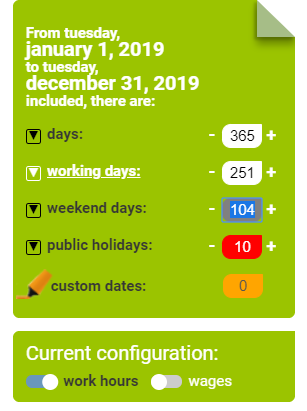

- Divide the salary difference by the number of payroll days in the calendar year to calculate the discrepancy in pay by day. You can find the number of payroll days using a free calendar tool from workingdays.us.

Free Working Days Calendar from workingdays.us

$2,500 salary difference ÷ 251 paydays in the calendar year = $9.96

$9.96 is the pay discrepancy by day

- Multiply the daily pay discrepancy rate (determined in Step 2) by the number of days paid incorrectly to calculate gross retroactive pay amount due.

$9.96 x 12 days = $119.52

$119.52 is the gross amount of retro pay owed Sue

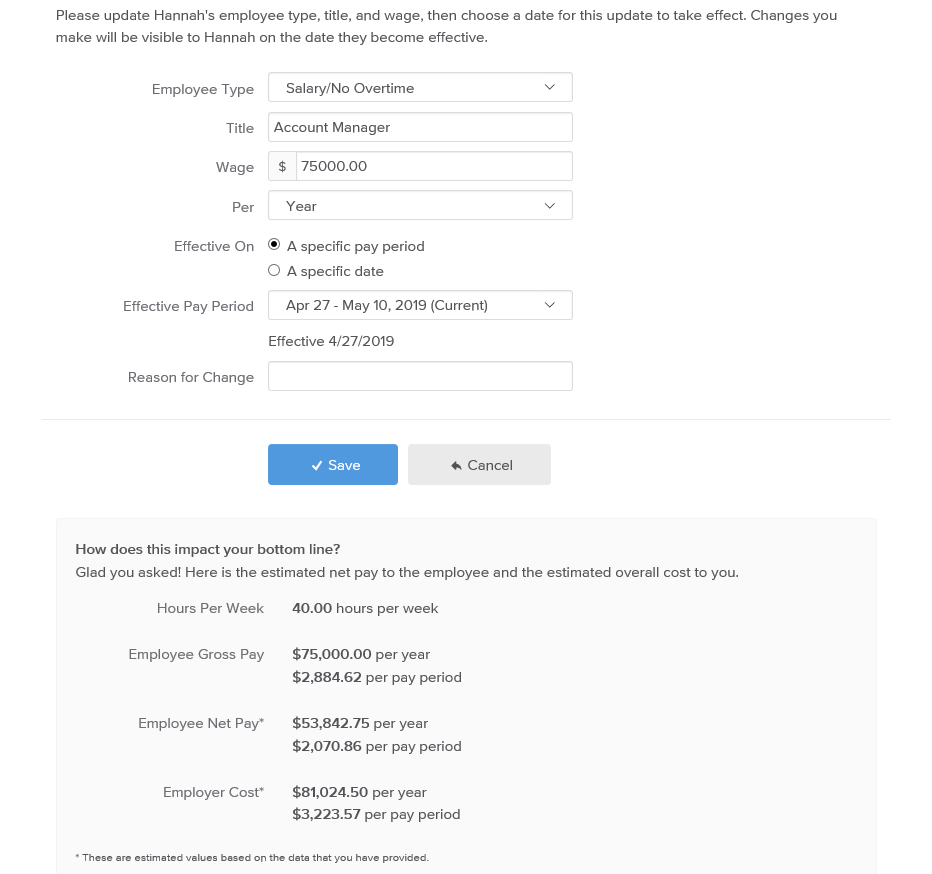

To avoid managing retro pay calculations, you can use Gusto to schedule a pay raise for the beginning of the upcoming pay period. Enter the new salary amount, specify the pay period in which it should take effect, and save.

Processing Retro Pay

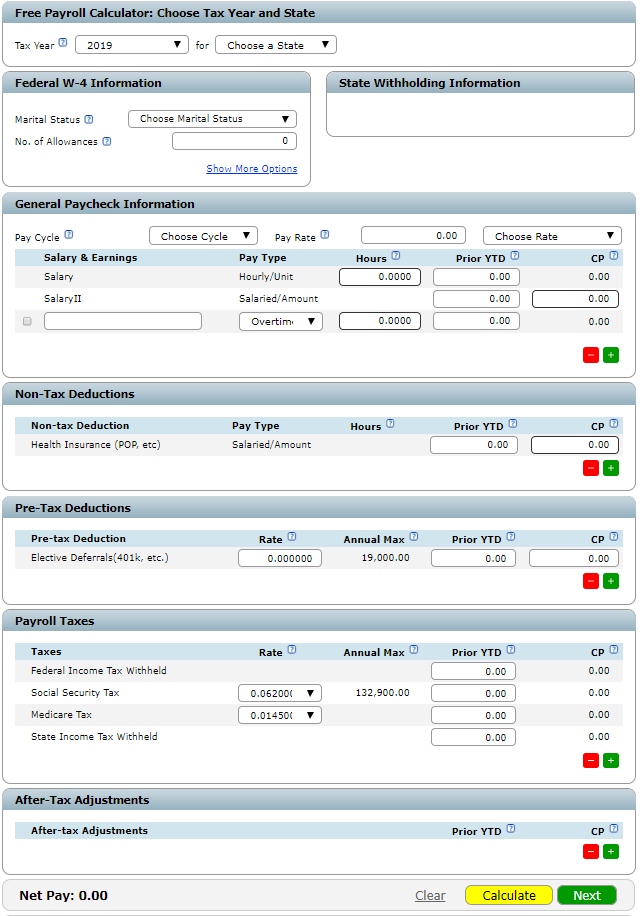

The best practice to manage payroll payment errors like retroactive pay is to process a separate off-cycle payroll run using software like Gusto, or calculate the amount manually using a free online paycheck calculator, like the one shown below. These options will allow you to pay the employee as soon as you realize the error.

Retro pay is taxable, whether paid as a lump sum or added to the next payroll in your existing payroll software. Regardless, you’ll need to make sure you deduct the correct payroll taxes from the retroactive payment.

Use a free paycheck calculator with taxes and deductions from www.paycheckmanager.com to determine how much retro pay your employee is owed. After calculating, you can print a free payroll check using the net amount provided.

Processing a special payroll run costs extra with some payroll providers (unlike Gusto) that charge a fee for each payroll generated. In most states, it’s acceptable to wait and add the additional amount to the employee’s check during the next pay cycle. Keep in mind, however, that if overtime is involved in the pay period in which the mistake was made, you’ll need to adjust for overtime hours and/or use an overtime pay rate when calculating retroactive pay.

Retro Pay Laws

Once your company establishes a pay cycle, you should pay employees consistently. When it comes to retroactive pay, you’ll need to pay attention to your state’s labor laws. If an employee is terminated, your state may require you to submit retroactive pay immediately. And in cases when the error resulted in an overpay, you may not be allowed to correct, such as in California.

Federal Law Payroll Rules Regarding Retro Pay

The Department of Labor (DOL) Wage and Hour Division states that employees must be paid each pay period and no later than 12 days from the end of the pay period. States vary on labor guidelines like minimum wage, the frequency and length of pay periods, records retention, and whether or not a paycheck must be provided immediately upon termination.

Similar to regular pay, retroactive pay needs to be paid as soon as possible to ensure federal and state labor law compliance. In most states, this means cutting the employee a separate check or paying them the retro pay due on the very next pay period.

States Prohibiting Negative Retro Pay or Late Payments

Negative retro pay is money employers overpaid to employees but decided to take back later. Several states like California, New Jersey, Texas, Illinois, and Washington have certain conditions under which an employer can take back pay for work that has already been done and incorrectly paid for at a higher rate or won’t allow it at all. For example, Texas requires advanced notification before pay can be decreased. In addition, Illinois assesses employer penalties for late payment of wages, failure to provide a final check on time or failure to pay out earned vacation.

Situations When Retro Pay Might Be Needed

There are common situations when retro pay might occur in a small business. It’s usually an accident that typically happens as a data entry or communications error. For example, incorrect information is entered on the time card or a raise is given but not communicated to the person running payroll.

Here are some more examples of situations in which you may need to calculate retroactive pay:

A pay raise: An employee received a pay raise of $1.15 an hour by the owner, but the owner forgot to inform the payroll department; payroll runs the employee’s last paycheck using the old pay rate to calculate earnings. The employee will need the difference paid as retro pay for the 40 hours in the prior period back to the date the raise should have taken effect.

$1.15 per hour x [40 hours paid at the wrong rate] = $46 gross retro pay due

A shift differential: An employee typically works as a server, but one shift a week they work as a supervisor with a shift differential of 50 cents extra per hour. The employee was paid for all hours, but eight of those hours were paid using their regular pay rate, not the supervisor pay rate, so their next check has to be adjusted with $4 miscellaneous income added as retro pay:

8 hours paid incorrectly x $.50 shift differential = $4 gross retro pay due

Overtime: An employee worked 43 hours last week, but work time was added to the payroll as 40 hours. The employee’s regular pay rate is $18 an hour. The additional three hours of retro pay not only need to be paid but paid at 1.5 times the regular pay rate as they are calculated as overtime in the prior pay period.

$18 regular pay rate x 1.5 overtime rate = $27 overtime pay rate

$27 overtime pay rate x 3 hours paid incorrectly = $81 gross retro pay due

A bonus:

The employee earned a $300 bonus for services they sold but did not receive the bonus on the pay period. The bonus can be paid with a separate $300 check as retro pay. There’s no retro pay calculation for this because it’s a flat amount. You will, however, need to deduct taxes; you can also gross up the bonus calculation―calculate the bonus amount you must pay out to ensure your employee receives a certain amount after taxes―to ensure the employee receives the amount you prefer.

Frequently Asked Questions (FAQs) About Retro Pay

In this article, we discussed how to calculate retro pay. However, we realize that some questions are asked more frequently than others, and we’ve addressed them here. If you have a question that’s not on our list, feel free to share it with us in our forum, and we’ll provide an answer.

How do you calculate retro pay?

You calculate retro pay by determining the difference between the pay rate that was paid vs the pay rate that should’ve been paid and multiplying by work hours to be corrected. For hourly employees, you’ll calculate an hourly rate differential to multiply by the hours paid incorrectly. For salaried employees, you’ll calculate an annual salary differential and divide by the number of days in the calendar year; then multiply by the number of days paid incorrectly.

What is the difference between retro pay and back pay?

Retro pay is a fix for payments that were made incorrectly in the past. Back pay is a fix for payment that was never disbursed for work that was completed in the past. Both are ways to pay amounts that should have been paid prior to the current period.

How does overtime impact retro pay?

For starters, you have to be aware of the hours worked for the pay period you’re trying to correct. If your retro pay calculation includes additional work hours that will cause the total hours for the prior period to exceed 40 in a week, you’ll need to calculate an overtime rate to pay for the hours above 40. This means the retro pay you disburse will be higher than it would’ve been had there not been any overtime.

Is retro pay mandatory?

Yes, retro pay is mandatory. Both federal and state laws govern how often you should pay employees for work they’ve completed. Failing to pay employees for their work can result in lawsuits and penalties if not corrected in a timely manner, so it’s best to pay as soon as it becomes obvious there was an issue with prior payment.

Bottom Line

Retro pay situations happen, and you must address the problem sooner rather than later. A best practice is to pay the employee with a separate payment as soon as you discover they’ve been paid incorrectly. However, in most states, you’re allowed to wait and add the retro pay amount onto the next pay period’s earnings.

The best way to avoid retro pay issues is to use a payroll system like Gusto that integrates with timekeeping software, Homebase. This will ensure you won’t end up with data entry errors as you move hours worked from your time clock to your payroll system. Gusto also provides HR and payroll support to ensure your payroll questions are answered correctly.