The way you choose how to calculate bonuses for employees can affect company morale. Performance bonuses encourage personnel to work toward achieving individual and company goals, and nonperformance bonuses can make everyone feel appreciated. You can multiply an employee’s total sales earned by a fixed bonus percentage or pay a flat rate to everyone.

Types of Employee Bonuses

Before we get into how to calculate a bonus, let’s consider the different types of bonuses you can pay out. Performance-based bonuses are based on key metrics, like sales volume, annual cost savings, and goals reached. Nonperformance-based bonuses can be based on an employee’s annual earnings, time of year, and traditional practices.

“I offer bonus structures that encourage the employee to hit goals they’ve not reached before in exchange for extra money that deserves it. By hitting goals that are harder to reach, you show someone their true potential, then by bringing in that extra revenue, it makes sense to show them extra revenue from it. When employees directly see and receive the results of their hard work, they take on a sense of ownership and pride within the company. I always scale a percent of revenue above their current plan. It streamlines it for me with one calculation and also shows me profitability too. The bonus structures I see that motivate people the most are extra cash, gift cards, and vacations. People are money motivated but also want experiences and security. Nothing shows this more than hitting big goals and being paid for it.”

– Jared Weitz, CEO and Founder, United Capital Source Inc.

Here are some of the most common bonuses companies pay their employees:

- Salary-based: Calculate these bonuses based on annual salary or wages for each employee. The higher their earnings, the more their bonus will be.

- Individual sales (sales commission): You must have a system for tracking sales by each individual employee for this to work. Decide how much of the sales total you want to pay (usually a percentage).

- Department goal: These are given when a particular team or department reaches a goal. You will need to decide how much of a bonus you want to give, which department earned it, and divide it among the individuals receiving it.

- Referral: Referral bonuses are usually flat dollar amounts and can be based on the number of new customers your employees refer. Some companies also pay them if they hire a job applicant an employee referred. You will need to decide how often to pay out.

- Holiday: Holiday bonuses are usually paid around Thanksgiving and Christmas. They’re nonperformance-based, and everyone usually receives them. These can be paid in cash or non-cash, such as holiday turkeys.

- Quarterly or annual: Quarterly and annual bonuses are sometimes contingent upon how well a company performs. For instance, if your company meets its annual net profit goal, you might pay out a percentage or flat rate.

- Retention: Retention bonuses are meant to encourage employees to stay with the company. Usually, these are the top earners on the team. Companies usually pay this when they suspect flight risk and believe they’re in danger of losing key customers.

- Sign-on: Sign-on bonuses are offered with new hire packages and are incentives for top job candidates to accept a position. Usually, this applies to executive and white-collar positions.

How to Calculate Bonuses for Employees

Some bonuses are easier to calculate than others. Performance-based bonuses are based on factors for which you may need to gather data, such as total sales revenue for the month or the number of new clients signed up during the year. You might also set an arbitrary amount, like $1,000, to pay nonperformance bonuses or calculate payouts based on individual salaries or work hours.

Andy Lambrecht, CEO of Jumpbeat Strategy, discusses the importance of structuring bonuses according to your organization’s goals:

“Make sure that bonuses are aligned with the strategy and vision of the business. If an element of the strategy is long-term growth, reward actions that progress the business toward the goal. Rewarding short-term actions that counteract long-term growth sidetrack the business from achieving its objectives.”

– Andy Lambrecht, CEO, Jumpbeat Strategy

Performance-based Bonuses

Performance-based bonuses can usually be calculated with simple multiplication or division. Before you begin, you’ll need to determine the percentage you plan to use if basing employee bonuses on factors like sales or salaries.

Sales Commission

To calculate a bonus for an employee who earns “X” dollars in sales, multiply the sales total by the bonus percentage you established. For example, let’s assume Kara was responsible for $50,000 in client sales for the year. If you opt to pay each salesperson 10% of the sales they earn, Kara would have earned $5,000.

$50,000 x 10% = $5,000

Let’s backtrack. If that $50,000 in client sales was a result of the efforts of 10 of your best sales team members instead of one, you could consider dividing it evenly among them. In this case, you would divide the $5,000 calculated (10% of sales) and divide it by 10 employees to get a total of $500 payable to each.

Department Goals

If you want to want to pay bonuses based on goals reached by a particular department or team, be sure you know how many people are in each. To calculate, divide the total bonus you want to distribute by the number of employees who will be receiving it.

For example, assume the accounting department set a goal of lowering this year’s expenses by 2%. You decided that the department would earn a total of $5,000 for the year if the goal is met. There are eight employees on the accounting team. How much would each employee receive?

- First, you will need to verify the company’s expenses from the prior year. Let’s assume they were $100,000.

- Next, you will need to verify expenses as of December 31 of the current year. Let’s assume they were $96,500.

- Once it’s clear expenses decreased, you have to calculate how much the decrease was (in percentage form).

$100,000 (prior year’s expenses) – $96,500 (current year’s expenses) = $3,500 (dollar amount of decrease)

$3,500 (dollar amount of decrease) / $100,000 (prior year’s expenses) = 0.035 or 3.5%

3.5% (year over year decrease) is greater than the 2% (goal)

The accounting department exceeded their goal by decreasing expenses 3.5% instead of 2%, so a bonus should be paid out.

- Finally, you can figure out how much each employee should receive.

$5,000 (total bonus) / 8 (total number of accounting employees) = $625 bonus

Each employee in the accounting department should receive a $625 bonus for current year.

Nonperformance-based Bonuses

Sometimes, employers opt to offer nonperformance-based bonuses to prevent resentment and jealousy among employees. When your workers notice only certain departments or positions being paid extra money, they may begin to feel unappreciated. Issuing nonperformance bonuses is an easy way to combat this and simplify calculation for you.

Percent of Salaries

If you want to ensure all of your employees receive a bonus, consider basing it on their annual salary or wages. You could offer 3%, and everyone would receive a check. To calculate, you will need access to all employee salary or wage amounts. You may need to use prior year figures to estimate annual wages for hourly employees (who don’t work consistent hours).

Andrei Vasilescu, CEO of Don’tPayFull, discusses how and why he pays his employees based on their annual salary amounts:

“I pay 15% of net yearly salary as a bonus to each of my employees. It means that if an employee earns a total $50,000 a year, he gets $7,500 as bonus. In addition to that, I distribute 10% of the total revenue my business earns every year among all my employees as an extra bonus. This two-fold bonus structure encourages my employees to pour their fullest effort in my business, and this simple bonus structure is very easy to calculate and disburse.”

– Andrei Vasilescu, CEO and Digital Marketing expert, Don’tPayFull

To calculate the bonus to be paid for a graphic designer who earns $55,000 a year and a secretary who earns $30,000, you would multiply the bonus rate—let’s assume 3%—by their salary amounts.

$55,000 X .03 = $1,650 (bonus for graphic designer)

$30,000 X .03 =$900 (bonus for administrative assistant)

In this example, employees who are paid more in regular salary will receive a higher bonus. This could still lead to some dismay since the bonus is determined the type of position each employee holds, but it ensures every staff member receives a payout.

Sign-on & Retention Bonuses

Both sign-on and retention bonuses are usually paid as flat rates, which means there’s no calculation necessary if it’s all paid out at one time. For example, if your policy states to pay new employees who relocated for the job a $2,500 sign-on bonus, you will distribute that amount.

The terms of a bonus agreement or policy might indicate the bonus should be paid in increments, and if that’s the case, you will need to determine how much you should distribute and how often.

Let’s assume Sally accepted a nursing position that offered a $3,000 sign-on bonus to be paid out over the course of her first four months on the job. In this case, you would divide the total $3,000 bonus by 4 to find the monthly bonus distribution you will need to make.

$3,000 (bonus) / 4 (months bonus should be distributed) = $750

This means you will need to distribute $750 to Sally each month during her first four months on the job. Retention bonus calculations work similarly but are usually paid out long after the employee is hired.

If you consider paying bonuses based on the number of hours each employee works, consider using When I Work. It’s a scheduling and time tracking software you can use to help ensure the work hours you use in your bonus calculations are correct. Sign up to use it free for up to 75 employees.

How to Calculate & Pay Taxes on Bonuses

Once you determine the type of bonus you want to pay and calculate accordingly, you need to decide how you will handle payroll taxes. Bonuses are taxable as supplemental wages, and the IRS gives you a couple of options on taxing the amount. You can opt to pay the employee’s regular tax rate by adding the bonus to his or her regular paycheck or pay it in a separate check and withhold 22%.

Pay Bonus With Regular Check Without Specifying Amount

If you pay a bonus with an employee’s regular paycheck by simply adding it to the gross wages earned without differentiating the amount from regular wages, the bonus tax rate will be the same as regular tax rates (7.45% FICA rates designated by law and income tax rates determined by the employee’s W-4 form). You’ll also pay your portion of FICA and unemployment taxes.

Separate Bonus Check From Regular Check

The IRS also gives you the option to pay employee bonuses using a completely separate paycheck. If you decide to use this option, you have two choices on how to tax the bonus.

Option 1 for Calculating Taxes on Employee Bonuses

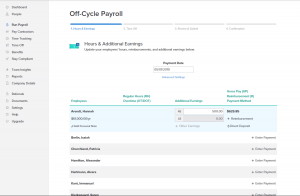

The first option is to withhold a flat 22% (no other percentage allowed) for taxes. Some of the best payroll software, like Gusto, gives you the option to run off-cycle bonus payments for free and will automatically withhold the 22% to help you maintain compliance.

Option 2 for Calculating Taxes on Employee Bonuses

The second option is to hypothetically add the bonus amount to the employee’s regular wages for the prior pay period to help you calculate how much in taxes to withhold. Once you add them together, you’ll need to determine the taxes that would’ve been withheld had the bonus actually been paid out. Then, subtract taxes paid for the prior period from that amount. The difference is what you should withhold from the bonus check.

Example: You pay Matthew Stark a biweekly salary on the first of each month. His February 1 pay is $2,000. Using his W-4 form and the IRS’ 2019 wage bracket tables to determine applicable tax rates, you withhold $251 for taxes. On February 15, he receives a bonus of $2,000. You choose to use the option of paying his bonus separate from regular wages using the prior period pay information.

Here’s how to calculate how much you should withhold for taxes:

- Add the bonus amount to the amount of wages from the most recent base salary pay date, February 1: ($2,000 in regular pay + $2,000 bonus = $4,000 total)

- Calculate the amount of withholding on the combined $4,000 to be $686 using the wage bracket tables.

- Subtract the amount withheld from wages on the most recent base salary pay date (February 1) from the combined withholding amount ($686 – $251 = $435).

- Withhold $435 from the bonus payment, meaning only pay the employee $1,565 ($2,000 bonus – $435 taxes).

Gross Up Bonus Checks

If you want your employees to receive a specific bonus amount after taxes, you can use the tax gross-up method to determine how much of a bonus you need to give. You will have to increase the bonus amount for this to work.

Here are the steps you need to follow to gross up employee bonuses:

- Sum all tax rates, including federal, state, and local, if applicable.

- Subtract the total tax rates from 1 (equivalent to 100%): 1 – tax rate = net percent employee will be paid.

- Divide the net payment by the gross percent.

- Verify your answer by calculating the gross payment to net payment, and then multiply the tax rate by the gross amount of the bonus to find taxes. Then deduct the taxes calculated from the gross payment. You should see the net pay you want your employee to have.

Example: You’re a Florida employer who’s paying a $500 bonus to an employee. Let’s follow the steps we discussed above.

- FICA taxes are 7.65%, the Federal supplemental wage rate is 22%, and there are no state or local income taxes to withhold. Total taxes are 29.65% (7.65% + 22%).

- 1 – .2965 = .7035 (net percent to pay employee)

- $500 (bonus) / .7035 = $710.73 (gross bonus payment)

- Verify the calculation:

$710.73 (gross payment) X .2965 (total tax rate) = $210.73 (taxes to be withheld)

$710.73 (gross payment) – $210.73 (taxes) = $500 (net pay for employee)

You can avoid going through these four steps by using a payroll software, like Gusto. All you have to do is enter the bonus amount you want your employee to have after taxes, and Gusto will calculate how much you need to pay in seconds.

Enter the net bonus amount you want your employees to receive after taxes, and Gusto will calculate the total you need to pay with the click of a button.

Pros & Cons of Paying Bonuses to Employees

Paying employee bonuses is a good way to rejuvenate your employees’ motivation in the workplace, but it can have negative consequences if you’re not careful. Some employees are particularly sensitive regarding issues of pay and will call out any instances during which they weren’t paid the same as others.

Pros of Paying Employee Bonuses

Here are some of the pros that come with offering bonuses:

- Improves performance: Bonuses tied to performance make it more likely that goals will be met.

- Lower employee turnover: Retention and other bonuses encourage employees to stay with the company longer so they can continue to reap rewards.

- Attracts more job candidates: Job applicants consider bonuses when reviewing salary offers. A bonus gives them more incentive to accept the offer.

- Higher productivity: Extra cash can motivate employees to continue doing their best, leading to more output for the business.

- Encourages innovation and healthy competition: When bonuses are tied to competition between departments, it encourages each team to focus on being the best. When every team is challenged and rises up to meet the challenge, innovation soars.

Cons of Paying Employee Bonuses

Here are some of the cons of paying employee bonuses:

- Can lead to resentment: When there’s disagreement about bonus structure, employees can feel unappreciated.

- Unrealistic expectations: Employees may expect the same bonus regularly.

- More expensive: Payroll taxes and wage expenses are higher.

- Unhealthy competition: When certain positions receive higher bonuses than others, employees can become more competitive and collaborate less.

- Unethical behaviors: If bonuses are based on sales, employees are more likely to use unethical selling tactics to boost their earnings; they may even misreport their actual sales numbers.

Frequently Asked Questions (FAQs) on How to Calculate Bonuses for Employees

Here are some common questions that employers ask about calculating bonuses. If you have additional questions on how to calculate a bonus or other small business topics, submit them on our forum.

How are bonuses taxed in 2019?

Employee bonuses are subject to a 22% federal withholding rate (can be lower or higher depending on whether you pay the bonus as a separate payment), and it may also be subject to state and local income taxes, depending on where the employee works and lives.

If you pay out a large bonus—over $1 million, the bonus funds above the first million will be taxed at a rate of 37% for federal income taxes. You must also withhold and pay 6.2% in Social Security and 1.45% in Medicare taxes on all bonuses paid.

What are some non-cash bonus ideas?

Some non-cash bonus ideas include giving holiday turkeys, additional vacation days, tickets to local sports events, books, and gift certificates. Remember to include these gifts in employee income for the year. For goods and services, use the fair market value to calculate the value of the gift.

What should I know about calculating bonuses for hourly employees?

The primary concern you should have about paying bonuses to hourly employees is the Federal Labor Standards Act (FLSA) requirement to include the bonus payment in the employee’s hourly rate when calculating overtime pay. The calculations can be complex, but the Department of Labor has online examples to help. Miscalculating can lead to underpaying employees and legal ramifications.

Bottom Line

Paying employee bonuses can be as simple as deciding on a flat rate to distribute to each employee or as complex as tracking metrics, calculating bonuses due, dividing the bonus among employees in a systematic way, and grossing up to cover taxes.

However you choose to structure your bonus plan, Gusto can support it. The software allows you to run a separate bonus payroll or add it into regular wages in your next payroll cycle. It only takes four to five steps to complete. Sign up for a 30-day free trial today.